Top Incubators for Startups in 2025: The Ultimate Guide for Founders

In the high-stakes world of startups, having a groundbreaking idea isn’t enough. Founders also need the right support system—access to funding, strategic mentorship, networks, and validation. This is where startup incubators step in.

Startup incubators act as launchpads, nurturing early-stage companies by offering guidance, resources, and in many cases, capital. Choosing the right incubator can significantly increase your chances of success, whether you’re building a SaaS platform, a healthtech solution, or a climate startup.

This article dives into the top incubators for startups in 2025, analyzing what makes them successful, who runs them, their funding models, and how you can get in.

🚀 What Is a Startup Incubator?

A startup incubator is a program or organization that helps startups grow during their initial stages. It provides:

- Mentorship from experienced entrepreneurs

- Seed funding or investor connections

- Workspaces and infrastructure

- Workshops and bootcamps

- Business development support

- Exposure to partners and customers

Unlike accelerators, incubators may not follow a fixed program cycle and often accept startups on a rolling basis.

🌍 Top Incubators for Startups in 2025

Below is a curated list of the best startup incubators globally, followed by a deep-dive profile on each.

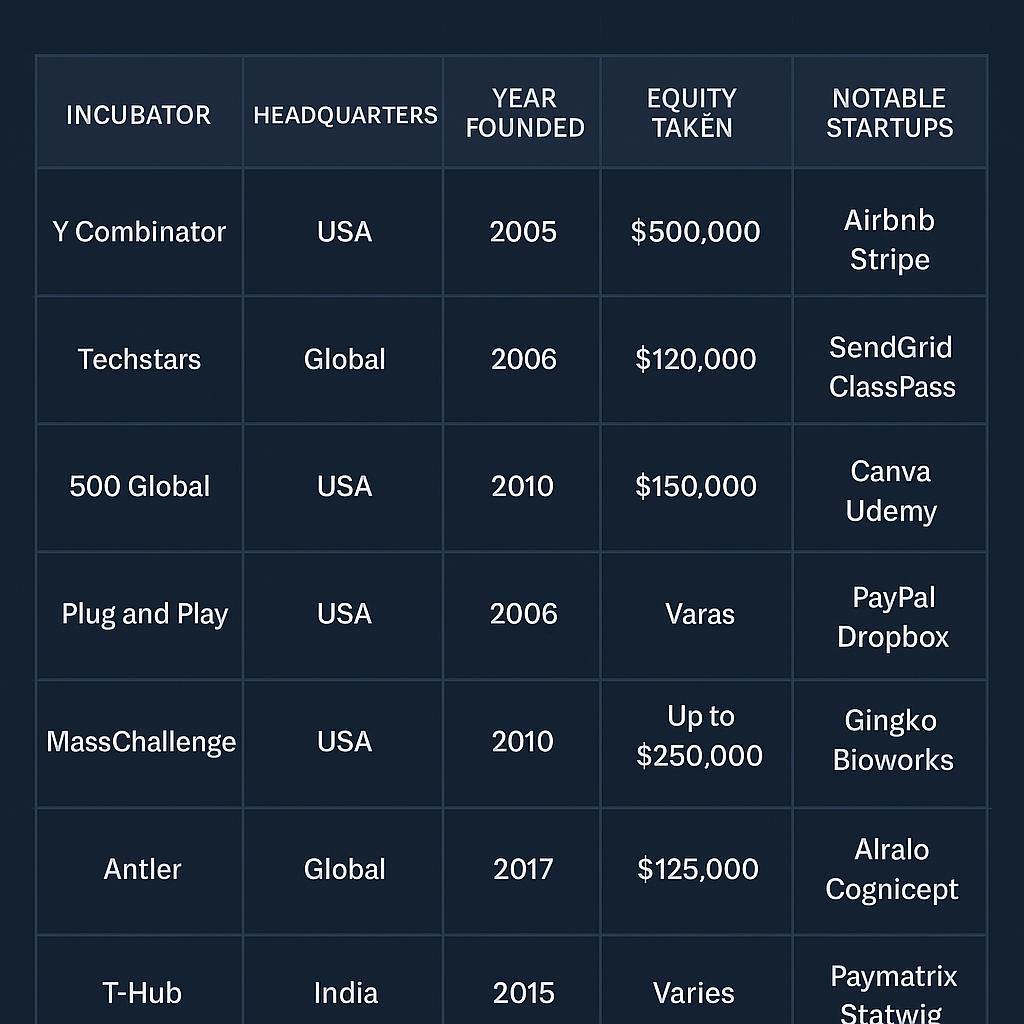

| Incubator | Headquarters | Year Founded | Equity Taken | Funding Offered | Notable Startups |

|---|---|---|---|---|---|

| Y Combinator | USA | 2005 | 7% | $500,000 | Airbnb, Stripe |

| Techstars | Global | 2006 | 6% | $120,000 | SendGrid, ClassPass |

| 500 Global | USA | 2010 | 6% | $150,000 | Canva, Udemy |

| Plug and Play | USA | 2006 | None | Varies | PayPal, Dropbox |

| MassChallenge | USA | 2010 | None | Up to $250K | Ginkgo Bioworks |

| Antler | Global | 2017 | 10% | $125,000 | Airalo, Cognicept |

| T-Hub | India | 2015 | None | Varies | Paymatrix, StaTwig |

🧠 How to Choose the Right Incubator

Consider the following when selecting an incubator:

- Domain Fit: Do they specialize in your vertical (e.g., AI, biotech, fintech)?

- Funding Model: Are they equity-free or do they take a stake?

- Mentorship Quality: Who are the mentors and how involved are they?

- Network Access: What investor or partner ecosystems can you access?

- Alumni Success: Have past startups succeeded?

🏢 In-Depth Incubator Profiles

1. Y Combinator (YC)

Headquarters: Mountain View, CA

Founded: 2005

CEO: Garry Tan

Investment Terms: $500,000 for 7% equity

Application Process: Biannual (Winter/Summer); highly selective; video + interviews

Funding History: Over 4,000 startups funded; cumulative valuation over $600B

Notable Startups: Airbnb, Dropbox, Stripe, Reddit

Post-Incubation: Alumni support, follow-on fundraising help

Contact: https://www.ycombinator.com/apply

Unique Value: YC has the strongest alumni network and is often a signal for investor attention. The 3-month program ends with a high-profile Demo Day.

2. Techstars

Headquarters: Boulder, CO

Founded: 2006

CEO: Maëlle Gavet

Investment Terms: $20K upfront, $100K optional convertible note for 6% equity

Program Locations: 30+ cities including Berlin, Bangalore, New York, London

Application Process: Rolling; reviewed by location/industry

Funding History: Over 3,500 startups supported

Notable Startups: DigitalOcean, ClassPass, SendGrid

Contact: https://www.techstars.com/accelerators

Unique Value: Emphasizes mentorship and corporate partnerships with Amazon, Barclays, and more. Excellent for global exposure.

3. 500 Global (formerly 500 Startups)

Headquarters: San Francisco, CA

Founded: 2010

Managing Partner: Christine Tsai

Investment Terms: $150,000 for 6% equity

Focus Areas: Edtech, Fintech, Deep Tech, SaaS

Program Duration: 4 months

Funding History: Over 2,800 startups in 75+ countries

Notable Startups: Canva, Udemy, Talkdesk

Contact: https://500.co/apply

Unique Value: Known for diversity, international expansion focus, and strong growth-hacking bootcamps.

4. Plug and Play Tech Center

Headquarters: Sunnyvale, CA

Founded: 2006

CEO: Saeed Amidi

Investment Terms: No equity; partners with corporations

Industry Tracks: Fintech, Health, Mobility, Insurtech, AI

Corporate Partners: 500+ including Google, Walmart, Shell

Funding History: Thousands of startups supported

Notable Startups: PayPal, LendingClub, Dropbox

Contact: https://www.plugandplaytechcenter.com/startups/

Unique Value: Offers unmatched access to corporations and market entry through innovation matchmaking—ideal for B2B startups.

5. MassChallenge

Headquarters: Boston, MA

Founded: 2010

CEO: Cait Brumme

Investment Terms: No equity; $250K in grants

Program Locations: U.S., Mexico, Israel, Switzerland

Application Process: Annual; highly competitive

Funding History: 3,000+ startups; $8B raised collectively

Notable Startups: Ginkgo Bioworks, Handy

Contact: https://masschallenge.org/programs

Unique Value: Nonprofit, equity-free model ideal for impact startups, health, cleantech, and sustainability innovators.

6. Antler

Headquarters: Singapore

Founded: 2017

CEO: Magnus Grimeland

Investment Terms: $125,000 for 10% equity

Locations: 25+ cities including London, Berlin, Nairobi, and New York

Application Process: Accepts solo founders; pre-idea stage welcome

Funding History: 900+ startups built from scratch

Contact: https://www.antler.co/apply

Unique Value: Designed for solo founders and idea-stage entrepreneurs. Offers founder-matching and early-stage investment.

7. T-Hub

Headquarters: Hyderabad, India

Founded: 2015

CEO: Srinivas Kollipara

Funding Terms: No equity for select government-backed programs

Focus Areas: Deep tech, AI, IoT, Blockchain

Partners: Intel, Facebook, Boeing, Indian Govt.

Notable Startups: Paymatrix, StaTwig, MyGate

Contact: https://www.t-hub.co/startups/

Unique Value: Ideal for Indian startups aiming for scale with government and enterprise support. Strong in hardware and IoT innovation.

📈 The Impact of Incubators on Startup Success

- 70% of incubated startups survive more than 5 years (vs 30% non-incubated).

- Incubated startups raise 4x more in Series A rounds.

- Startups from YC, Techstars, and 500 Global collectively contribute over $1 trillion in market cap globally.

📌 FAQs About Startup Incubators

Do incubators provide funding?

How do I get accepted?

Is it worth giving equity to an incubator?

Are there virtual incubators?

✅ Final Thoughts

Getting accepted into one of the top incubators for startups is a milestone worth pursuing. These programs offer far more than money—they provide a gateway into a powerful ecosystem that helps you grow, adapt, and raise funds. Whether you’re bootstrapping in Bangalore or pitching VCs in Silicon Valley, a top incubator can dramatically shift your startup’s trajectory.

Keep Reading:

- Best Pitch Deck Examples That Helped Startups Raise Millions

- Your topics | Multiple stories: Mastering the Multi-Angle Content Strategy for Growth

- Hailey Bieber’s Rhode Acquired by e.l.f. in $1B Deal

- Salesforce Acquires Cloud Data Management Giant Informatica in $11 Billion Deal

- Paramount-Skydance $8 Billion Merger Finalized: A New Era in Global Entertainment